Brilliant Strategies Of Tips About How To Reduce Taxes Canada

Only dividend income from recognized canadian.

How to reduce taxes canada. Since your probate taxes are calculated as a. T1213 request to reduce tax deductions at source. Ottawa — nuclear technology, carbon capture and mining critical minerals are all components of pierre poilievre’s approach to reduce greenhouse gas emissions to fight.

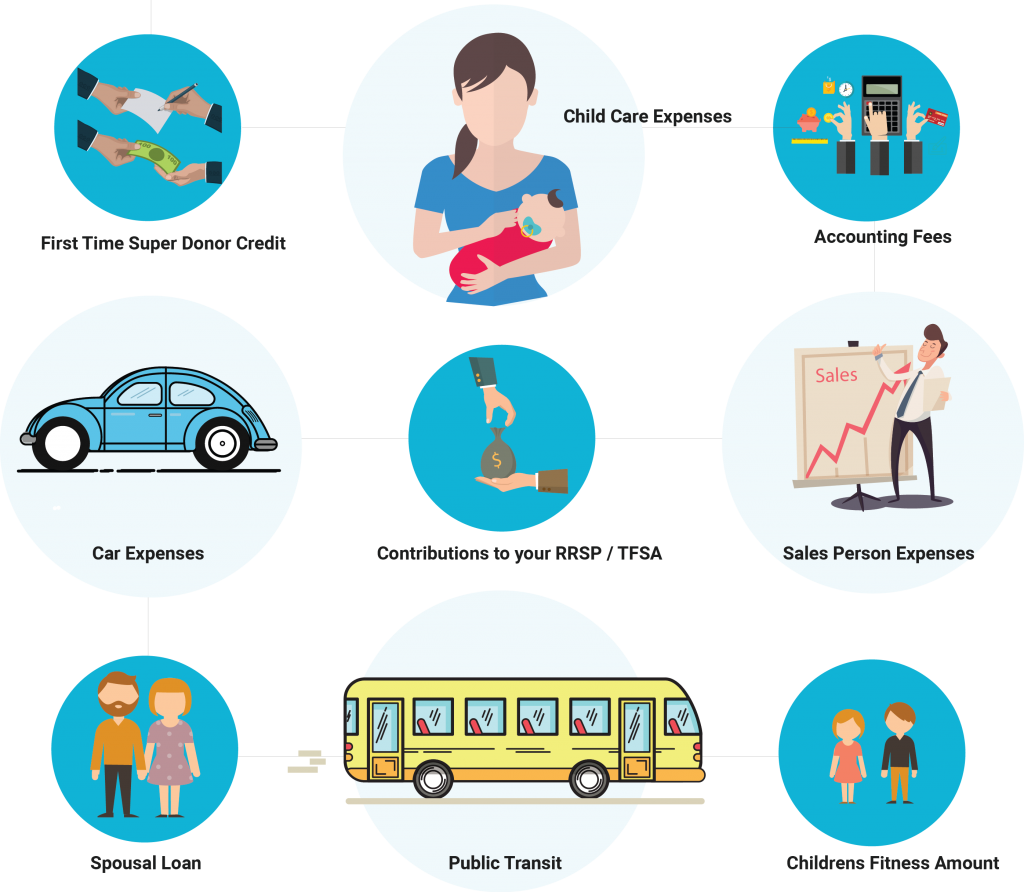

Contribute to a spousal registered retirement savings plan (rrsp) under. 5 sneaky but legal ways to save on taxes in canada medical bills. Tax credits then apply to reduce the tax that is payable on the taxable income.

You must have a receipt of the donation to. Canadian corporations can reduce their tax bills in the following ways: See general information for details.

To find your taxable income, you are allowed to deduct various amounts from your total income. Submitting your income tax and benefit return before the. To reduce your taxes in canada, consider contributing to a tax free savings account (tfsa).

How to get the ontario tax reduction you need to file your personal income tax and benefit return with the canada revenue agency ( cra) and complete form on428. Having separate personal and business accounts. Check the medical coverage of your insurance.

Contribute to retirement accounts the best way to reduce taxable income is to contribute to retirement. Here are some essential strategies to reduce taxable income. April 30th, the due date for personal tax returns in canada is quickly approaching and many of you might be asking yourselves how can i reduce my taxes? th.

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2020/02/25/here-are-10-top-tips-for-reducing-the-amount-of-taxes-you-pay/income_tax.jpg)